Introduction to Forex Chart Patterns and Indicators for Profitable Trading

The realm of forex Chart Patterns and Indicators for Profitable Trading is a dynamic interplay of global financial markets, where currencies fluctuate rapidly and are exchanged with precision. In this volatile space, the mastery of Forex Chart Patterns and Forex Indicators plays an instrumental role in achieving Profitable Forex Trading. This blog promises a deep dive into these essential tools, unraveling their intricate designs, to equip traders for effectively navigating the foreign exchange market’s ebbs and flows.

Forex Chart Patterns, the symbolic footprints of the market, impart crucial knowledge about the market’s heartbeat. These patterns, be they triangles, head and shoulders, flags, or other designs, offer priceless clues regarding future price trajectories. A proficient understanding of these patterns, and an ability to decode them, can serve as ab potent strategy in the trader’s arsenal, offering a roadmap to potentially lucrative trades.

Yet, these chart patterns are just fragments of the expansive Forex Trading Strategies. Complementing them are the Forex Indicators, pivotal analytical instruments that shine a light on market trends, momentum shifts, and potential trend reversals. With tools like moving averages, relative strength index (RSI), or stochastic oscillators, these indicators act as beacons, illuminating a trader’s path in the often stormy seas of forex.

For both budding traders keen on cementing a robust foundational understanding, and veterans aiming for further refinement, our all-encompassing guide on Forex Chart Patterns and Forex Indicators is poised to be an invaluable resource. Let’s jointly embark on this enlightening expedition, unlocking the strategies underpinning successful, Profitable Forex Trading.

What Are Forex Chart Patterns?

Forex chart patterns are pivotal tools in profitable forex trading, offering profound insights into potential price movements and serving as key forex trading strategies. These patterns, combined with vital forex indicators, help traders predict future market trends rooted in historical data and patterns. In this comprehensive blog post, we will delve into various forex chart patterns, alongside techniques of technical analysis and the importance of support and resistance levels in charting.

Head and Shoulders

Explanation and Significance: The Head and Shoulders pattern is one of the most reliable reversal patterns, often signaling a shift from bullish to bearish sentiment or the opposite. Manifesting through three peaks – a central higher peak (head) flanked by two lower peaks (shoulders) – this pattern provides a clear representation of changing market sentiment. The information it provides becomes an instrumental part of profitable forex trading strategies, guiding traders in deciding optimal entry and exit points.

How to Recognize It: Pinpointing a Head and Shoulders pattern necessitates recognizing these crucial elements:

- The initial shoulder, characterized by a price rise followed by a decline.

- The head, standing taller than the shoulders, emerging as the price climbs once again.

- The subsequent shoulder, mirroring the height of the former, appearing as the price surges yet again.

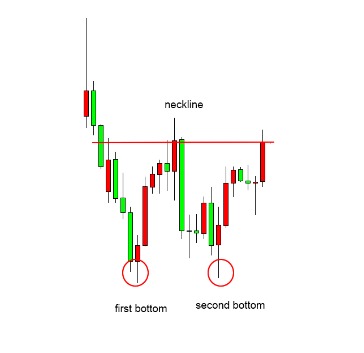

Double Top and Double Bottom

Explanation and Significance: Double Top and Double Bottom patterns, rooted in technical analysis, act as reversal indicators, hinting at potential shifts in ongoing trends. While a Double Top emerges post an uptrend indicating a potential bearish reversal, a Double Bottom appears following a downtrend, signaling a bullish reversal. For those eyeing support and resistance levels, these patterns can be invaluable.

How to Recognize It: To discern these patterns, one must observe:

Double Top: Twin peaks of almost identical height separated by a trough.

Source: BabyPips

Double Bottom: Dual troughs of similar depth, divided by a peak.

Source: BabyPips

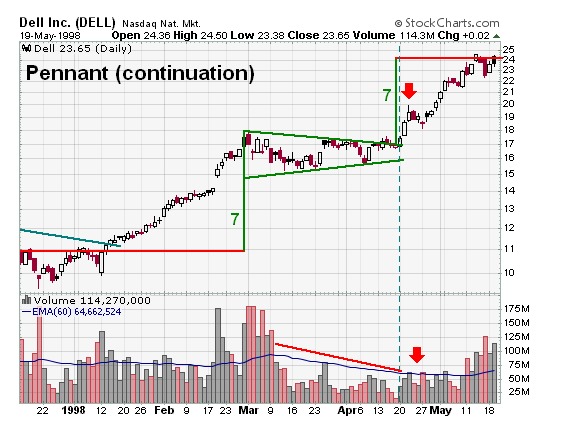

Flags and Pennants

Explanation and Significance: Flags and Pennants, often used in tandem with moving averages, are continuation patterns, symbolizing a brief halt in the dominant trend, which is likely to resume post this pause. While Flags exhibit a rectangular form and slope counter to the prevailing trend, Pennants resemble small equilateral triangles. These patterns, intertwined with candlestick patterns, shed light on impending price movements post a concise consolidation phase.

How to Recognize It: To pinpoint Flags and Pennants, be on the lookout for:

- Flags: A rectangular design with trendlines that run counter to the main trend.

- Pennants: Petite symmetrical triangles characterized by converging trendlines.

Source: StockCharts

Understanding Forex Indicators for Profitable Trading

Forex trading strategies often rely on a combination of technical analysis tools, including popular forex indicators like moving averages and the RSI. Here’s a closer look at how some of these vital tools work:

Moving Averages

What are Moving Averages? Moving averages, one of the most used Forex Indicators, serve as essential tools in profitable forex trading, assisting traders in deciphering price trends over specific durations. By averaging out closing prices over a predetermined period, they render trends and potential reversal points more visible.

How to Use Moving Averages Traders harness moving averages in diverse ways, such as discerning trend direction, pinpointing feasible entry and exit zones, and validating trend vigor. Varieties like the simple moving averages (SMA) and exponential moving averages (EMA) cater to different trading needs.

Example: A 50-day SMA on a currency pair’s daily chart can be instructive. A price cross above the SMA might hint at a bullish trend, whereas a dip below could allude to a bearish shift.

Relative Strength Index (RSI)

What is RSI? The Relative Strength Index (RSI) stands as a momentum oscillator gauging the velocity and alterations of price shifts. Positioned between 0 to 100, it’s invaluable for detecting overbought and oversold scenarios in forex chart patterns.

How to Interpret RSI Forex traders frequently view RSI readings above 70 as overbought—signalling a probable descent. In contrast, values below 30 signify oversold conditions, which may herald a rising trend. Beyond these thresholds, RSI serves to corroborate trend robustness.

Example: An RSI soaring to 80 on a currency pair could be a beacon for potential selling or profit booking, pointing to an overbought situation.

MACD (Moving Average Convergence Divergence)

What is MACD? MACD or Moving Average Convergence Divergence is a dynamic forex indicator fusing the strengths of moving averages with oscillator features. It equips traders to spot impending trend reversals, momentum drifts, and divergences.

How to Interpret MACD For actionable insights, traders observe MACD crossovers. When the MACD line surges above the signal line complemented by positive histogram bars, it might be a clarion call to adopt a bullish stance on a currency pair.

To ensure a successful foray into the realm of forex trading, understanding these forex indicators is imperative. These tools offer a lens into price directions, momentum and pivotal entry and exit junctions in the forex market.

How to Combine Chart Patterns and Indicators for Effective Trading

Navigating the intricate terrain of the forex market demands mastery over both forex chart patterns and forex indicators. This blog post dives deep into the potent combination of these vital tools, showcasing how they can robustly boost your forex trading strategies.

The Importance of Multiple Time Frame Analysis

What it is: Multiple Time Frame Analysis (MTFA) stands out as an indispensable technique that forex traders employ to obtain a holistic view of market directions and potential trading positions. Rather than limiting one’s focus to just one time frame, MTFA encourages an examination of price fluctuations across diverse time frames, be it daily, hourly, or even at the minute level, offering a panoramic insight into market behaviors.

Why it matters: Embracing MTFA is integral as it paves the way for traders to pinpoint high-probability trading opportunities within the vast landscape of forex trading. By synchronizing trends spanning different time frames, traders can diminish the occurrence of false signals, thus fine-tuning their decision-making process. For instance, when a bullish pattern revealed on a daily chart is complemented by bullish indicators on shorter time frames, it translates to a more compelling buy cue.

Case Study: Successful Trading with Patterns and Indicators

Real-world example: Let’s delve into a practical scenario, underscoring how the blend of forex chart patterns and forex indicators can set the stage for triumphant trading outcomes.

Imagine an investor’s gaze is fixed on the EUR/USD currency pair. A conspicuous bullish turnaround pattern – the “Double Bottom” emerges on the daily chart, insinuating a potential shift from a downtrend to an upward trajectory. But our astute trader isn’t solely dependent on this pattern; they fuse it with the insights from forex indicators.

A paramount forex indicator – the Moving Average Convergence Divergence (MACD) comes into play. The trader scrutinizes the MACD across both daily and hourly charts. The daily chart’s MACD histogram projects a bullish divergence, signaling that the tide might be turning in favor of the bulls. In tandem, the hourly chart witnesses the MACD surpassing its signal line, endorsing the bullish momentum in the short term.

In this scenario, the bullish pattern displayed on the daily chart, coupled with corroborative signals from the MACD spanning two time frames, consolidates into a compelling rationale for a prospective long trade on the EUR/USD pair. With a clear strategy encompassing stop-loss and take-profit parameters rooted in this combined analysis, the trader steps into the market.

As events unfold, this synergetic use of forex chart patterns and indicators fortifies the trading approach, culminating in a favorable outcome. This practical example illuminates the profound impact of harmonizing patterns and indicators, amplifying the chances of achieving success in the unpredictable realm of the forex market.

To sum up, mastering forex chart patterns and forex indicators isn’t merely about grasping individual components; it revolves around harnessing their collective strength. Through Multiple Time Frame Analysis and tangible case studies, it becomes evident that integrating these tools can empower traders, refining their forex trading strategies and elevating their effectiveness.

Top 5 Mistakes to Avoid

The dynamic world of forex trading demands a profound grasp of Forex Chart Patterns and various indicators for Profitable Forex Trading. Both newbie and seasoned traders sometimes stumble upon standard pitfalls while navigating these tools. This blog delves deep into the top 5 blunders you should sidestep when decoding forex chart patterns and utilizing forex indicators. By consciously evading these missteps, traders can bolster their decision-making prowess and amplify their success rate in forex.

Neglecting Fundamental Analysis:

While mastering the Technical Analysis associated with Forex Chart Patterns is essential, an often-overlooked aspect is fundamental analysis. Many traders place undue emphasis on technical tools but overlook key fundamental factors like economic news, geopolitical shifts, and central bank directives. Such oversight can often usher in unsound trading decisions and unexpected downturns.

Overcomplicating Chart Patterns:

Though forex charts are laden with details, it’s a typical error to overanalyze these chart patterns. Some traders try to spot every conceivable pattern, inducing a state of overwhelm and hesitation. Concentrating on predominant patterns, such as the classic triangles, head and shoulders, or double peaks and troughs, and mastering them can be more beneficial.

Misinterpreting Indicator Signals:

Forex Indicators, like Moving Averages, Relative Strength Index (RSI), and Stochastic Oscillator, often serve as beacons for traders. Yet, misconstruing these indicators’ nuances can pave the way for flawed trading choices. It’s imperative for traders to fully grasp each indicator’s intricacies and judiciously amalgamate them, mitigating the risk of spurious signals.

Ignoring Risk Management:

Central to Profitable Forex Trading is astute risk management. An all-too-frequent lapse is the scant regard some traders pay to risk management tenets, such as instituting stop-loss commands and adhering to optimal position allocation. Ignoring these principles can leave traders vulnerable, even if their proficiency in chart pattern scrutiny is commendable.

Emotional Trading:

Emotions, especially when unchecked, can wreak havoc in the forex realm. The twin forces of fear and avarice often propel rash moves, culminating in inconsistent trading patterns. Successful traders maintain a stoic discipline, staying anchored to a cogent trading blueprint. This strategy should encapsulate both entry and exit routes founded on Forex Chart Patterns and Indicators, coupled with an unwavering allegiance to risk management.

Conclusion

Diving deep into the realm of Forex Chart Patterns and Forex Indicators is a pivotal move for anyone aiming to proficiently maneuver through the intricate currency markets. These Profitable Forex Trading tools provide critical perspectives on market sentiment, likely price trajectories, and optimal points for trade initiation or conclusion. Familiarizing oneself with chart configurations such as candlestick patterns, triangles, and flags aids traders in predicting price turnarounds and breakthroughs, facilitating smarter decision-making. Moreover, leveraging technical analysis tools such as moving averages, RSI, and other Forex Trading Strategies enhances signal validation, minimizing the chances of misleading indicators.

Yet, it’s vital to comprehend that the landscape of forex trading carries inherent risks, and no particular chart pattern or indicator promises unfailing results. Employing rigorous risk management tactics, maintaining discipline, and perpetual learning remain quintessential for sustained profitability. Whether you’re an amateur just dipping your toes or a seasoned trader refining your techniques, mastering Forex Chart Patterns and related indicators is a quintessential asset in your trading toolkit. Persistent refinement in deciphering and utilizing these resources can bolster more assured and insightful trading actions, elevating your probability of triumph in the ever-evolving world of forex trading.

FAQs

- What are the most reliable Forex indicators? Reliable Forex indicators vary by trader preference, but popular ones include Moving Averages, Relative Strength Index (RSI), and MACD. Choose indicators that align with your trading strategy.

- How do I choose the right time frame for my analysis? Select a time frame that matches your trading style. Short-term traders often use 1-hour or 15-minute charts, while long-term traders prefer daily or weekly charts.

- Can I trade using just chart patterns or indicators? You can trade using either chart patterns or indicators, but a combination of both often provides more robust signals and confirmation.

- What’s the difference between leading and lagging indicators? Leading indicators, like RSI, provide signals before a trend change, while lagging indicators, like moving averages, confirm trends after they’ve started.

- How do I backtest a trading strategy? Backtest by applying your strategy to historical data to assess its performance. Use specialized software or trading platforms for this purpose.

- Is it necessary to use multiple indicators? Multiple indicators can enhance accuracy, but avoid overloading your charts. Focus on a few that complement each other.

- What are the key psychological aspects of trading with charts and indicators? Emotional discipline is crucial. Avoid impulsive decisions and stick to your trading plan. Manage risk and accept losses as part of the process.

- Can I apply these techniques to other forms of trading or investment? Yes, chart analysis and indicators are applicable to various asset classes, including stocks, commodities, and cryptocurrencies.

- How do I manage risk when using forex indicators? Implement risk management strategies, like setting stop-loss orders, diversifying your trades, and not risking more than a small percentage of your capital on a single trade.

- What tools can I use for real-time forex chart analysis? Popular charting platforms include MetaTrader, TradingView, and NinjaTrader, which offer real-time Forex charting and analysis tools.