Introduction

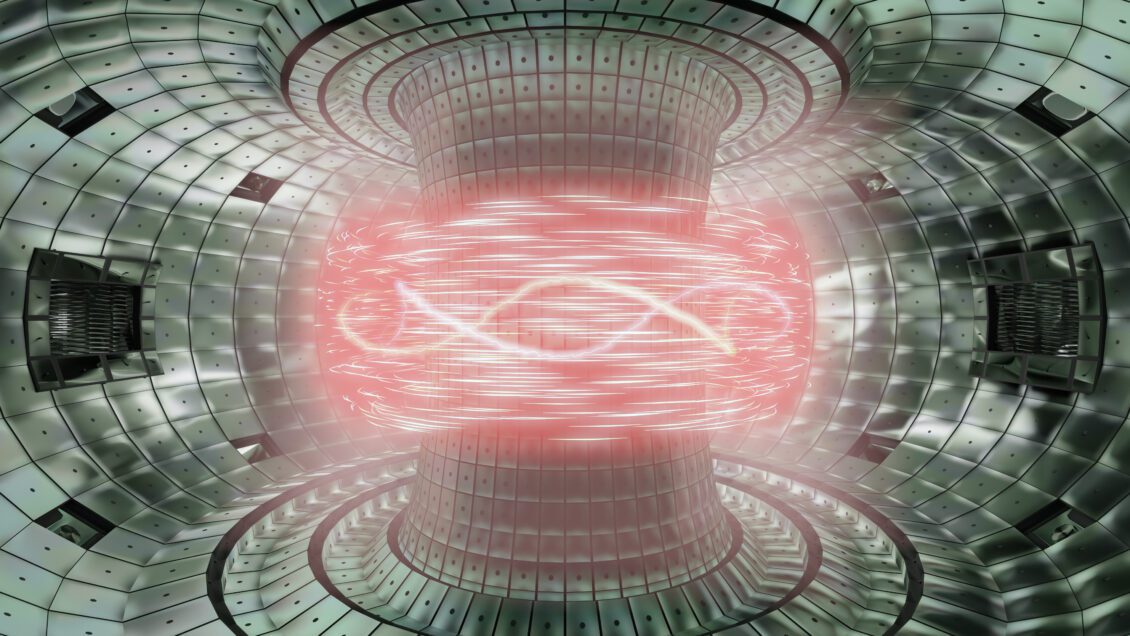

The foreign exchange (forex) market is a complex web of interconnected factors, and it is constantly influenced by various global events. One of the groundbreaking areas of research that has the potential to reshape the global economic landscape is fusion energy. Fusion energy promises to be a game-changer, offering a clean and virtually limitless source of power. In this article, we will delve into the potential economic impacts of breakthroughs in fusion energy research on forex markets, with a particular focus on energy sector investments, technological spin-offs, and shifts in global energy supply dynamics.

I. Fusion Energy Breakthroughs: A Catalyst for Economic Change

A. Energy Sector Investments

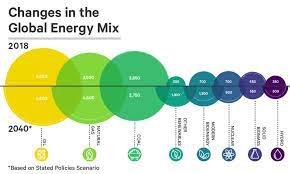

The foreign exchange (forex) market’s sensitivity to developments in the energy sector is a cornerstone of economic analysis. The potential breakthroughs in fusion energy research are poised to wield a profound influence on investor sentiment within the forex market. As nations and corporations engage in a competitive race to harness the transformative potential of fusion energy, a noticeable surge in investments in related industries is anticipated. This surge is likely to be accompanied by a discernible decline in investments in traditional energy sources, such as fossil fuels, as the global focus pivots toward cleaner and more sustainable alternatives.

- Increased Investment in Fusion Energy Companies

The realization of breakthroughs in fusion energy research is expected to trigger a reorientation of investment patterns, with investors redirecting funds toward companies at the forefront of this revolutionary technology. Corporations that specialize in fusion research, development, and implementation are poised to experience an unprecedented surge in growth. As these companies advance in their efforts to harness the power of fusion, the energy sector’s investment landscape is destined to undergo a profound transformation.

Investors are likely to view fusion energy companies as key players in the future energy landscape, catalyzing significant financial backing. These investments will not only fuel the further development of fusion technologies but also stimulate related industries and sectors. Ancillary technologies, infrastructure, and services that support fusion energy endeavors may also witness an uptick in investment, contributing to a broader economic ripple effect.

- Impact on Traditional Energy Stocks

Conversely, traditional energy stocks, particularly those tied to fossil fuels such as oil, gas, and coal, are poised to face considerable challenges. As breakthroughs in fusion energy materialize, investors will inevitably reevaluate their portfolios, considering the promising advancements in fusion as a sign of an imminent shift toward cleaner and more efficient energy sources.

The traditional energy sector may experience fluctuations in stock values, reflecting investor anticipation of a fundamental change in the global energy landscape. Oil companies, historically dominant players in the energy market, could see a decline in valuation as the market factors in the potential decline in demand for their products. This shift in investor sentiment may prompt traditional energy companies to reassess their strategies and pivot towards cleaner alternatives to remain competitive in the evolving energy market.

In essence, the forex market will play a crucial role in reflecting and amplifying these shifts in investment patterns. As the global energy sector undergoes a seismic transformation, investors and traders in the forex market will need to stay vigilant and adapt their strategies to capitalize on emerging opportunities while navigating the challenges posed by the evolving dynamics of fusion energy research.

B. Technological Spin-Offs and Innovation

Fusion energy research, while primarily centered in the energy sector, has the potential to transcend its boundaries, giving rise to a multitude of technological innovations with far-reaching consequences. The forex market, renowned for its rapid responsiveness to technological advancements, is expected to reflect and amplify the impact of these innovations, thereby influencing the competitive landscapes of various industries.

- Ripple Effects on Technology Stocks

The technological spin-offs stemming from fusion energy research, spanning disciplines such as materials science, superconductors, and artificial intelligence, are poised to exert a substantial influence on the performance of technology stocks in the forex market. As breakthroughs in fusion energy lead to advancements in these fields, investors will keenly monitor companies adept at capitalizing on these spin-offs, foreseeing potential growth and competitive advantages.

Materials Science Advancements: Fusion energy research often necessitates breakthroughs in materials science to withstand extreme conditions. Companies at the forefront of developing novel materials for fusion reactors may find themselves in high demand. Investors in the forex market are likely to adjust their portfolios, favoring stocks of companies that demonstrate expertise in materials science, as these advancements could have applications beyond the energy sector.

Superconductor Technologies: Fusion reactors frequently rely on superconductors to achieve optimal efficiency. Companies contributing to advancements in superconductor technologies may witness increased attention from investors. Forex markets may react to these developments, with traders seeking opportunities in technology stocks connected to superconductor innovations.

Artificial Intelligence Integration: Fusion research often involves complex simulations and data analysis, driving advancements in artificial intelligence (AI). Companies leveraging AI technologies in fusion-related endeavors may experience heightened interest from investors. The forex market is likely to respond with fluctuations in technology stocks associated with innovative AI applications.

- Intellectual Property and Innovation Indexes

The creation of valuable patents and intellectual property resulting from breakthroughs in fusion energy research is expected to reshape indices tracking innovation and intellectual property within the forex market. As companies secure patents related to fusion technologies, these indices may witness significant changes, reflecting the growing importance of intellectual property in the rapidly evolving technological landscape.

Increased Trading Activity on Innovation Indexes: The forex market may respond to breakthroughs in fusion energy research by experiencing an uptick in trading activity on innovation and intellectual property indexes. Investors seeking exposure to companies driving technological advancements may increasingly turn to these indexes, viewing them as reliable indicators of growth potential in the ever-changing landscape of technological innovation.

Navigating the Forex Landscape: Traders and investors operating in the forex market will need to stay attuned to the evolving technological developments stemming from fusion energy research. As these innovations permeate various industries, understanding their implications for specific technology stocks and innovation indexes will be crucial for making informed trading decisions. The forex market’s responsiveness to technological advancements underscores the need for adaptability, as opportunities and risks emerge in tandem with the transformative effects of fusion energy research on the broader technological landscape.

II. Shifting Global Energy Supply Dynamics

A. Impact on Currency Valuations

Fusion energy’s transformative potential extends beyond the realm of technological advancements, reaching into the heart of global economic structures and influencing the valuation of currencies. The emergence of fusion as a viable and competitive alternative in the global energy supply landscape is poised to instigate significant shifts in currency valuations, particularly for nations heavily reliant on traditional energy exports.

- Petrocurrencies and Fusion Energy

Countries traditionally dependent on the export of fossil fuels, colloquially known as petrocurrencies, face a paradigm shift as fusion energy emerges as a realistic alternative. The forex market is likely to react with volatility, reflecting the market’s anticipation of disruptions to the revenue streams of nations whose currencies are closely tied to oil exports.

Fluctuations in Petrocurrencies: Currencies linked to oil, such as the Russian Ruble and the Norwegian Krone, could experience fluctuations as the market prices in the potential decline in demand for traditional energy sources. Investors and traders will closely monitor these currencies, adjusting their positions based on the perceived impact of fusion energy on global energy consumption.

Diversification Efforts: Nations heavily reliant on petrocurrencies may explore diversification strategies to mitigate the risks associated with a diminishing role for fossil fuels. Forex markets will reflect the success and effectiveness of these diversification efforts, shaping investor sentiment and influencing currency valuations.

B. Geopolitical Considerations

Geopolitics and energy security are intricately intertwined, and breakthroughs in fusion energy research have the potential to reshape global geopolitical alliances and rivalries. Countries at the forefront of fusion technology development may gain strategic advantages, impacting forex markets as investors reassess geopolitical risks.

- Strategic Investments in Fusion Technology

Countries strategically investing in fusion technology are positioned to experience strengthened currencies as the forex market recognizes their potential to lead in the new energy era. Investors may view these nations as pioneers in a revolutionary shift toward cleaner and more sustainable energy sources, leading to increased confidence in their economic stability.

Enhanced Geopolitical Influence: Nations making significant strides in fusion technology may witness an enhancement of their geopolitical influence. The forex market will reflect this by adjusting currency valuations in favor of countries perceived as leaders in the transition to fusion energy. Investors may strategically allocate their funds to currencies associated with geopolitical stability and technological leadership.

- Challenges for Nations Lagging Behind

Conversely, nations lagging behind in fusion research may face challenges as investors reassess their economic prospects and geopolitical influence. The forex market may respond with cautious sentiment towards currencies associated with countries slower to adopt fusion technology, potentially leading to depreciations and increased volatility.

Adaptability in Geopolitical Dynamics: The evolving geopolitical dynamics spurred by fusion energy research underline the need for adaptability in forex trading strategies. Traders must stay vigilant, monitoring geopolitical developments and their impact on currency valuations as nations position themselves in the emerging era of clean and abundant energy.

In conclusion, the advent of fusion energy as a disruptive force in the global energy landscape is poised to have profound implications for currency valuations. The forex market, being highly responsive to economic shifts, will play a crucial role in reflecting and amplifying these changes as nations navigate the challenges and opportunities presented by the fusion energy revolution.

III. Risk and Uncertainty in Forex Markets

A. Regulatory Considerations

The progression of fusion energy research introduces a new dimension of risk and uncertainty to the forex market, necessitating a close examination of regulatory considerations. As governments and regulatory bodies grapple with the implications of fusion energy breakthroughs, their decisions will significantly influence how the forex market responds to this transformative energy source.

- Policy Impact on Forex Markets

The regulatory landscape surrounding fusion energy will be instrumental in shaping the forex market’s response. Governments worldwide face the challenge of establishing clear guidelines and incentives to facilitate a smooth transition from traditional energy sources to fusion. The implementation of supportive policies can mitigate risks and uncertainties for investors, fostering a more stable trading environment.

Volatility Introduced by Regulatory Changes: Changes in energy policies, subsidies, and regulations can introduce volatility to forex markets. Governments actively promoting and incentivizing fusion energy may experience increased investor confidence, positively impacting their respective currencies. Conversely, regulatory challenges or resistance to change may lead to uncertainty and potential currency depreciation, as investors seek clarity and stability.

Investor Confidence and Regulatory Alignment: Forex traders will closely monitor the alignment of regulatory frameworks with the development and adoption of fusion energy. Clear and supportive policies can boost investor confidence, attracting capital to countries leading the way in fusion research and implementation. Regulatory uncertainty, on the other hand, may drive investors away, creating fluctuations in currency valuations.

B. Investor Sentiment and Speculation

The forex market, driven not only by fundamental factors but also by investor sentiment and speculation, is particularly susceptible to the dynamics surrounding breakthroughs in fusion energy research.

- Balancing Optimism and Realism

Investors navigating the forex market must strike a delicate balance between optimism and realism regarding the potential of fusion energy. The optimism surrounding groundbreaking technological advancements can lead to speculative trading, causing short-term fluctuations in currency values as traders react to news and rumors.

Speculative Bubbles and Corrections: The anticipation of widespread adoption of fusion energy may give rise to speculative bubbles in the forex market. Traders, driven by exuberant optimism, may engage in speculative buying, inflating currency values. However, a realistic assessment of the challenges and timelines associated with fusion energy’s adoption is crucial to prevent prolonged speculative bubbles. Corrections may occur as market participants adjust their positions based on a more sober evaluation of the situation.

Pragmatic Approach for Stability: A pragmatic approach to fusion energy, considering both the potential and the challenges realistically, can contribute to more stable forex market conditions. Traders and investors who base their decisions on a thorough understanding of the technological, economic, and regulatory landscape surrounding fusion energy are likely to navigate the market more effectively, avoiding excessive speculation and contributing to market stability.

In conclusion, the risk and uncertainty introduced by breakthroughs in fusion energy research demand careful consideration of regulatory factors and an awareness of the interplay between investor sentiment and speculation in the forex market. As fusion energy transitions from the laboratory to the global energy stage, the ability to navigate these challenges will be paramount for traders seeking to capitalize on the opportunities while mitigating the associated risks in the dynamic forex landscape.

Conclusion

The forex market, a dynamic and responsive arena, mirrors the ever-changing global landscape. Breakthroughs in fusion energy research hold the promise of ushering in a new era marked by economic opportunities and challenges that reverberate across the globe. As nations and corporations strategically position themselves at the forefront of this transformative technology, the forex markets become the navigational compass through the shifting currents of energy sector investments, technological spin-offs, and the restructuring of global energy supply dynamics.

The Potential for Economic Opportunities:

- Energy Sector Investments: The anticipated surge in investments in fusion energy companies is indicative of the potential economic opportunities that lie within this burgeoning industry. Investors, recognizing the transformative potential of fusion energy, are expected to redirect funds toward companies spearheading research, development, and implementation. This influx of capital not only propels the growth of these companies but also catalyzes advancements in related industries, fostering economic growth.

- Technological Spin-Offs and Innovation: Fusion energy research extends its impact beyond the energy sector, giving rise to technological innovations that resonate across various industries. The forex market responds to these innovations, presenting opportunities for investors to capitalize on advancements in materials science, superconductors, and artificial intelligence. Companies adept at leveraging these technological spin-offs stand to gain a competitive edge, and forex markets become the canvas where these opportunities unfold.

The Necessity for Vigilance and Adaptability:

- Global Energy Supply Dynamics: Fusion energy’s transformative potential extends to the restructuring of global energy supply dynamics. This shift has direct implications for currency valuations, particularly for nations heavily dependent on traditional energy exports. The emergence of fusion as a viable alternative introduces a level of volatility that requires investors and traders to stay vigilant, adapting their strategies to navigate the evolving landscape.

- Regulatory Considerations and Geopolitical Dynamics: Regulatory frameworks, energy policies, and geopolitical considerations play pivotal roles in shaping the forex market’s response to fusion energy breakthroughs. Governments’ regulatory decisions and strategic investments in fusion technology can influence investor confidence and impact currency valuations. A balance between optimism and realism is essential as the geopolitical landscape undergoes transformations that may introduce uncertainties and risks.

In conclusion, the fusion energy revolution is not merely a scientific breakthrough but a catalyst for profound economic changes. The forex market, with its sensitivity to global events, emerges as a critical player in navigating the complexities associated with the fusion energy transition. Traders and investors, armed with foresight and adaptability, are poised to capitalize on the opportunities presented by this transformative technology while mitigating the inherent risks. As the world inches closer to a new energy era, the forex market remains at the forefront, reflecting and shaping the economic landscape in the wake of fusion energy’s revolutionary impact.

Read our latest article on Desalination

FAQs

1. How does breakthroughs in fusion energy research impact the forex market?

Answer: Breakthroughs in fusion energy research can significantly impact the forex market by influencing investor sentiment, reshaping energy sector investments, and triggering fluctuations in currency valuations tied to traditional energy exports.

2. What is the potential impact of fusion energy advancements on traditional energy stocks in the forex market?

Answer: Advancements in fusion energy research may lead to fluctuations in traditional energy stocks as investors reevaluate their portfolios in anticipation of a shift towards cleaner and more efficient energy sources.

3. How might technological spin-offs from fusion energy research affect technology stocks in the forex market?

Answer: Technological spin-offs, such as advancements in materials science and artificial intelligence, can influence the performance of technology stocks in the forex market as investors monitor companies capitalizing on these innovations for potential growth and competitive advantages.

4. What role do regulatory considerations play in the forex market in response to fusion energy breakthroughs?

Answer: Regulatory considerations play a crucial role in shaping the forex market’s response to fusion energy breakthroughs. Governments establishing clear guidelines and incentives can mitigate risks and uncertainties for investors.

5. How might changes in energy policies impact the forex market in the context of fusion energy research?

Answer: Changes in energy policies, subsidies, and regulations can introduce volatility to forex markets. Governments promoting fusion energy may see increased investor confidence, positively impacting their currencies.

6. What are petrocurrencies, and how might they be affected by the emergence of fusion energy?

Answer: Petrocurrencies are currencies linked to oil, and they may face challenges as fusion energy becomes a viable alternative. Currencies tied to traditional energy exports, like the Russian Ruble and Norwegian Krone, could experience fluctuations.

7. How can countries strategically investing in fusion technology impact their currency valuations?

Answer: Countries strategically investing in fusion technology may witness strengthened currencies as the market recognizes their potential to lead in the new energy era, reflecting positively on their economic stability.

8. How do breakthroughs in fusion energy research influence investor sentiment and speculation in the forex market?

Answer: Breakthroughs in fusion energy research can trigger speculative trading in the forex market, leading to short-term fluctuations in currency values as traders react to news and rumors.

9. Why is it essential for investors to balance optimism with a realistic assessment of fusion energy’s potential?

Answer: Balancing optimism with realism is crucial for investors to avoid speculative bubbles. A pragmatic approach contributes to more stable forex market conditions as it considers the challenges and timelines associated with widespread adoption.

10. In the context of fusion energy research, how does the forex market reflect and shape geopolitical considerations?

Answer: Geopolitical considerations in fusion energy research may reshape alliances and rivalries. Countries at the forefront of fusion technology may gain strategic advantages, impacting forex markets as investors reassess geopolitical risks.

Click here to read more on Fusion Energy